BRD Global

Class A, Class E and Class USD

Open-ended investment fund with placements predominantly in global equity markets such as the United States of America, Europe and Japan. The fund will make investments mainly through tradable ETF-type UCITS.

The fund promotes environmental and social characteristics and considers that the issuers in which it invests directly or indirectly follow good governance practices.

The fund's strategic allocation is 75% in equities or ETFs with exposure to global equity markets and 25% in other assets such as deposits and fixed income financial instruments. Through the investments made, the fund aims to offer clients high liquidity and diversification.

The performance of the Fund may be influenced by the negative performance of one or more financial markets in which the Fund invests. In this sense, there is no form of guarantee for the investments made by investors.

Who does it suit?

You can choose this fund if you want to invest in the international capital markets for the long term. If you want a diversified portfolio of shares listed in the United States, Europe, Japan as well as other markets then this fund may be for you. Given the profile of the fund, it suits you if you have a long-term investment horizon and are willing to accept a high degree of risk. You can invest in this fund in RON, EUR and USD currencies.

ISIN Fond Class A: ROFDIN0001E7

ISIN Fond Class E: ROQDDMSGKS66

ISIN Fond Class USD: ROP5L22AK6R8

Decizie autorizare ASF: 453/30.03.2010

Registru ASF: CSC06FDIR/400065/30.03.2010

GIIN: YCEN9M.00007.SF.642

LEI: 5493004713YDSTEKZF64

Urmărește evoluția Class A pe Bloomberg*

Urmărește evoluția Class E pe Bloomberg*

Urmărește evoluția Class USD pe Bloomberg*

* Informațiile sunt prelucrate și puse la dispoziție de entitatea-terță Bloomberg, iar BRD Asset Management S.A.I. S.A. nu iși asumă nicio responsabilitate cu privire la conținutul informațiilor furnizate de Bloomberg.

The information and data presented are intended to allow clients and potential clients of BRD Asset Management S.A.I. make an informed investment decision. By consulting this material, you agree to access and use this data exclusively for investment purposes.

mediu spre scăzut (Class E)

mediu (Class USD)

History

Monthly Newsletter - 31.08.2024

Documents

Sustainability-related disclosures

Sustainability information

Product name: Open-ended Investment Fund BRD Global

Classification under EU Regulation 2088/2019: art. 8

LEI: 5493004713YDSTEKZF64

Version 1

Date: 31.07.2023

Information on Open-ended Investment Fund BRD Global promoting environmental and social characteristics

(a) Synthesis

The Open-ended Investment Fund BRD Global (FDI BRD Global) is a financial product that invests in global equity markets, mainly through tradable UCITS (undertakings for collective investment in transferable securities) – ETFs – with equity exposure. In allocating investments, the Fund takes into account the size and importance of the various financial markets, so the main exposures will be to mature markets such as the United States, Europe or Japan, but may also invest in assets with exposure to other markets. The Fund promotes environmental and social characteristics by constructing a portfolio of equities and equity securities issued by ETFs with enhanced environmental, social and governance (ESG) characteristics at the aggregate portfolio level. In order to substantiate investment decisions, ESG analysis will be complementary to specific evaluations from financial sector. In selecting ETFs and individual stocks, the Fund will use ESG techniques such as „positive screening” or „exclusionary screening”, the use of ESG scores from an external data provider (Morningstar), as well as exclusion lists and identification lists to build a portfolio with improved environmental, social and governance characteristics, with the aim of contributing to reducing ESG risks globally.

The Fund will invest at least 50% of the 75% total Fund exposure to equities and ETFs as per the strategic allocation, in:

• tradeble UCITS (ETFs) which are financial products referred to in Article 8 of EU Regulation 2019/2088: promote, inter alia, environmental or social characteristics or a combination thereof, provided that the companies in which the investments are made follow good governance practices;

• tradable UCITS (ETFs) which have a sustainable investment as its objective and have designated an index as a reference benchmark (financial products referred to in Art. 9 of the EU Regulation 2019/2088, without the fund expressly seeking to hold a minimum proportion in such investments).

This financial product promotes environmental or social characteristics, but does not aim to make sustainable investments, nor does it aim to have a minimum proportion of sustainable investments.

The Open-ended Investment Fund BRD Global aims to contribute to the reduction of global environmental and social risks by building a portfolio with global exposure to equities and tradable UCITS (ETFs) that have exposure to global equity markets, with enhanced environmental, social and governance (ESG) characteristics at the aggregate portfolio level.

In order to promote environmental and social characteristics by building an overall portfolio with enhanced ESG characteristics, the Fund will use specific ESG methods:

• checking the positive information ("positive screening") or checking the negative information/ the information from exclusion list ("exclusionary screening") in order to build a portfolio with improved environmental, social and governance characteristics to help reduce ESG risks globally;

• use of ESG scores from an external data provider (Morningstar), which calculates ESG scores for ETFs and equities based on ESG analysis made by Sustainalytics at the companies level . ESG scores provided by Morningstar are measured in Globes (5 Globes represent the best score and 1 Globe represents the weakest score);

• investing only in ETFs or individual stocks rated with at least 3 Globes;

• the prohibition of direct investment in issuers included in the exclusion list containing information on companies, activities/countries to be avoided in the light of the analysis of the exclusion criteria from the ESG Policies issued by the Group to which BRD Asset Management S.A.I. belongs;

• prohibition of direct investment in issuers included in the identification list containing information on companies, projects or types of activities (in certain regions or worldwide) for which a potential social or environmental risk has been identified. This list is based on Societe Generale Group's mapping of social and environmental risks as well as external sources;

• prohibition of indirect investment in issuers on the exclusion list and the identification list: ETFs' holdings will be regularly checked to avoid indirect exposure to companies on the exclusion list or the identification list.

• ensuring a weighted average Globes Score for ETFs greater than 3.5. The weighted score will be monitored on an ongoing basis and if it falls below 3.5, the Fund's portfolio will be rebalanced within a reasonable timeframe and in the best interest of investors;

• ensuring a weighted average Globes Score for equities greater than 3.5. The weighted score will be monitored on an ongoing basis and if it falls below 3.5, the Fund's portfolio will be rebalanced within a reasonable timeframe and in the best interest of investors.

The exclusion list includes information on the companies, activities/countries to be excluded under the analysis of the exclusion criteria from the ESG Policies issued by Societe Generale Group.

The identification list includes information on companies, projects or types of activities (in certain regions or globally) for which a potential social or environmental risk has been identified.

This list is based on the Group's mapping of social and environmental risks as well as external sources.

When investing in ETFs with similar characteristics such as geographical exposure, assets under management, costs, the Fund will select instruments that are rated with a higher ESG score according to Morningstar. The Fund will invest at least 50% of the 75% of its total Fund exposure to equities and ETFs as per the strategic allocation, in:

• tradable UCITS (ETFs) which are financial products referred to in Article 8 of EU Regulation 2019/2088: they promote, inter alia, environmental or social features or a combination of these characteristics, provided that the companies in which the investments are made follow good governance practices;

• tradable UCITS (ETFS) which have a sustainable investment as its objective and have designated an index as a reference benchmark (financial products referred to in Art. 9 of the EU Regulation 2019/2088, without the fund expressly seeking to hold a minimum proportion in such investments).

The Open-ended Investment Fund BRD Global invests in global equity markets, in particular through ETFs with equity exposure. In allocating investments, the Fund will take into account the size and importance of the various financial markets, so that the main exposures will be to mature markets, such as those in the United States, Europe or Japan, but may also invest in assets with exposure to other markets, subject to the conditions and limits specified in the prospectus and in compliance with the regulations in force.

In order to substantiate investment decisions ESG analysis will be complementary to the specific evaluations from financial sector.

In order to assess the good governance practices of investee companies, including sound management structures, employee relations, staff remuneration and tax compliance, FDI BRD Global uses Morningstar ESG ratings. One of the three pillars included in Sustainalytics' company-level ESG analysis on which Morningstar ratings are based is governance (G). Sustainalytics' company governance analysis looks at companies' structures, practices and behaviours, as well as their ability to create long-term value for shareholders and other stakeholders in a transparent manner. Specifically, the following aspects are considered: management quality and integrity, governance structures, shareholding and shareholder rights, remuneration, audit and financial reporting, and relations with other stakeholders.

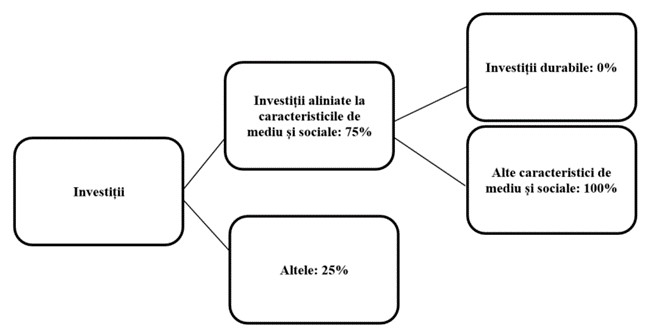

The Fund's strategic (long-term) asset class allocation is 75% in equities, ETFs with exposure to global equity markets or individual equities. The exposure to equities will mainly be indirect through ETFs but may also have direct exposure to entities through individual equities. The remaining 25%, according to the strategic allocation, includes other assets such as deposits, government securities, fixed income financial instruments, usually in the form of direct exposure.

For the purposes of monitoring the compliance with the environmental and social characteristics, the weighted average Globes Score of the ETFs held in the Fund's portfolio must not be less than the equivalent of 3.5 Globals (as measured by Morningstar ratings). The weighted score will be monitored on an ongoing basis and if it falls below 3.5, the Fund's portfolio will be rebalanced within a reasonable timeframe and in the best interest of investors.

In addition, the weighted average Globes Score of the shares held in the Fund's portfolio must not be less than the equivalent of 3.5 Globes (as measured by Morningstar ratings). The weighted score will be monitored on an ongoing basis and if it falls below 3.5, the Fund's portfolio will be rebalanced within a reasonable timeframe and in the best interest of investors.

The Fund will have no exposure to ETFs or individual stocks rated less than 3 Globes by Morningstar. The ETFs or individual shares tradable UCITS score check is performed prior to investment and periodically during the holding of the instrument in the portfolio.

The Fund will not invest in individual shares on the exclusion list or identification list. ETFs Holdings will be screened to avoid indirect exposure to companies on the exclusion list or identification list. The screening of ETF holdings and individual shares held directly in the Fund's portfolio against companies on the two lists shall be carried out prior to investment and periodically during the holding of the instrument in the portfolio.

The measurement of how well the environmental and social characteristics promoted by the FDI BRD Global are met is based on ESG scores provided by an established provider, Morningstar, which calculates scores for ETFs and equites based on ESG analysis at company level performed by Sustainalytics.

Morningstar assigns ratings that assess the ESG characteristics of financial instruments, called Globes, based on Sustainalytics' company-level analysis. For ETFs, Morningstar calculates a weighted average score of the ESG scores of the companies in which the ETF has invested, called the „Portfolio Sustainability Score”. It ranges from 0 to 100, with lower scores indicating lower ESG risks. For an ETF to obtain such a score, at least 67% of its holdings must have ratings from Sustainalytics. The sustainability score of ETFs is calculated taking into account only holdings that have a rating from Sustainalytics. For the purpose of assigning ESG ratings called Globes, Morningstar groups ETFs according to the global Morningstar category to which they belong and ranks them in ascending order by portfolio sustainability score. Based on a normal distribution, the portfolios ordered ascending by ESG score are divided into five categories: the first category contains the ESG portfolios with the lowest ESG risks – to which is assigned 5 Globes rating (the best score on the Morningstar scale), continuing in the same way to the last category containing the portfolios with the highest ESG risks – to which is assigned 1 Globe rating (the weakest score on the Morningstar scale).

Sustainalytics' analysis for assessing ESG risks at the company level takes into account the industry-specific risks the company is part of and how well the company manages the industry-specific risks in which it operates. This multi-dimensional way of assessing a company's ESG risks combines the concepts of risk management and risk exposure in order to obtain an absolute assessment of a company's ESG risks. Based on ESG scores, companies are classified into five ESG risk categories ("negligible", "low", "medium", "high", „severe”). Based on Sustainalytics analysis, Morningstar assigns Globes to the five categories mentioned above ranging from 5 Globes (best score) to 1 Globe (weakest score). For example, 5 Globes correspond to the category with negligible ESG risks, while 1 Globe corresponds to the category with severe ESG risks.

The Open-ended Investment Fund BRD Global uses ESG scores from an established provider (Morningstar which performs valuations for ETFs and equities based on ESG company-level analysis performed by Sustainalytics) in order to build a portfolio with enhanced ESG characteristics. The methodology used by Morningstar has been described under (g) Methodologies for environmental or social characteristics in this document. Another source of data is the exclusion and identification lists issued by Societe Generale Group, described in (g) Methodologies for environmental or social characteristics in this document.

Data quality is ensured by using approved sources (ESG scores are taken from Morningstar and exclusion and identification lists are provided by Societe Generale, based on the Group's mapping of social and environmental risks as well as external sources). In order to use up-to-date data and for ongoing monitoring, ESG scores provided by Morningstar and exclusion and identification lists provided by Societe Generale Group are regularly checked.

For data processing purposes, the ESG assessments used to monitor the ESG characteristics and risks of the Fund are obtained through a platform provided by the provider. Exclusion and identification lists are provided by Societe Generale Group and are developed and updated in line with Societe Generale Group's general environmental and social principles. Based on the ESG ratings by which Mornigstar assesses the ESG risk of financial instruments, individual equities and ETFs, the weighted average score of equities or ETFs financial instruments held in the portfolio is calculated for the FDI BRD Global. The effective exposure of financial instruments of type shares or ETFs is rescaled to 100%. According to the strategic (long-term) allocation, the Fund's exposure to equities and equity ETFs is 75%, with the remaining 25% representing other assets (bank deposits, government securities, etc.). Actual exposures may vary from these levels depending on market conditions.

For the purpose of determining the weighted average score of equities or ETFs held in the Fund's portfolio, S.A.I. does not estimate ESG ratings. The Fund invests exclusively in equities and ETFs that are ESG rated by Morningstar.

One of the limitations of the methodology described above is determined by the way Morningstar assigns ESG ratings to ETFs. In order for an ETF to obtain an ESG rating from Morningstar (in the form of Globes) it is sufficient that 67% of its holdings to be covered by ESG analysis performed by Sustainalytics, this percentage is then rescaled to 100% and the weighted score refers to the entire ETF. Therefore, it is possible that, although the ETF has an ESG score from Morningstar, not all of its portfolio holdings are covered by Sustainalytics. This limitation is partially mitigated by the fact that Morningstar conditions an ETF rating by the fact that more than two-thirds of its holdings are covered by an ESG analysis.

Updates of Morningstar's ESG ratings and Societe Generale's exclusion and identification lists are made regularly, but given the complex nature of ESG issues, there is a risk that the identification of ESG risks to be reflected with a delay.

As the ESG field is relatively new, ESG analysis in essence presents some challenges: data available at company level may be incomplete, non-standardised and inaccurate, the assessment methodology used by different rating and assessment providers is different which may lead to distinct assessments of ESG risks.

Some of the limitations mentioned above are inherent in the ESG field due to the complexity of the risks covered by the topic, but also because their analysis and integration into the investment process is relatively recent. FDI BRD Global promotes environmental and social characteristics in a general sense with the intention to contribute to reducing sustainability risks globally. Given the Fund's global exposure and related diversification, the use of ESG ratings from an established provider that incorporate a wide range of ESG issues that are updated regularly should not affect the Fund's ability to meet environmental and social characteristics.

BRD Asset Management S.A.I. has implemented through internal governance regular controls to ensure that the obligations undertaken are met. Thus, the underlying assets of the FDI BRD Global are periodically reviewed in order to limit the ESG risks of the Fund by checking the following aspects: (i) the ESG scores of the UCITS and individual shares held in the portfolio do not fall below a score of 3 Globes, as assessed by Morningstar, otherwise the financial instrument that no longer meets this condition will be disinvested within a reasonable period of time and with due regard to the interests of investors; (ii) the weighted average Globes Score of the equities or ETFs held in the Fund's portfolio must not be less than the equivalent of 3.5 Globes (as rated by Morningstar), otherwise the Fund's portfolio will be rebalanced within a reasonable time frame and in the best interest of investors and (iii) ETFs and individual equities holdings will be reviewed periodically so as to avoid exposure to issuers on the Societe Generale Group's exclusion or identification lists taking into account the Societe Generale Group's environmental and social principles, and otherwise the financial instrument will be disinvested.

In the case of the FDI BRD Global, engagement is not part of the environmental or social investment strategy. However, the Fund will support initiatives likely to contribute to improving the environmental, social or governance characteristics of the issuers in which it invests. The Fund will vote against initiatives that could contribute to increasing the environmental, social or governance risks of the issuers in which it invests and against initiatives that are in contradiction with ESG principles recognised in established international treaties (e.g. United Nations Global Compact).

The BRD Global FDI does not have a specific index designated as a benchmark to determine whether the financial product is aligned with environmental and/or social characteristics.

Archive

Activity report june 2017

Mai mult

BRD Acțiuni

Open end Fund investing primarily in stocks but also in monetary instruments. Is seeking for relative high financial…