Being able to be financially disciplined is learned. PlanInvest, your scheduled subscription can help. You certainly have heard of the effect of compound interest, even Albert Einstein considers it the eighth wonder of the world!

What is it like not to depend on your salary for more than 20 years to the same extent that you now depend on it? Remember, your plans for the future relate to the actions of the present.

Being able to be financially disciplined is learned. PlanInvest, your scheduled subscription can help. You certainly have heard of the effect of compound interest, even Albert Einstein considers it the eighth wonder of the world!

What is it like not to depend on your salary for more than 20 years to the same extent as you now depend on? How does it sound? Join us in the following lines.

Be careful how and how much you spend, even if this is not always easy to do. We propose a routine in this regard, which will help you to be part of a discipline from a financial point of view. It is very important to have control over your monthly expenses and we can help you do that. With each scheduled subscription you pay yourself before other expenses.

If you wonder what is the connection between the scheduled subscription and the "time saving" you will find out that it is quite simple, with only one visit to the bank, the money is automatically sent from your account to the chosen investment fund. In other words put the money to work for you.

Anything well done needs time.

When in doubt about what to choose, choose diversification. It's so simple. Benjamin Graham, a well-known investment consultant of the 20th century, proposes in this respect a suggested minimum weight for shares of 25% and consequently a maximum in fixed income instruments of 75% in his work "Smart Investor". Another tip from this:

Here are the average annual returns recorded by the main investment classes over time:

| Class | 1926 – 2016 | 2007 - 2016 |

|---|---|---|

| Equity | 11.1% | 7.3% |

| Corporate bonds | 6.0% | 6.9% |

| Governmental bonds | 5.5% | 6.5% |

| T-bills | 3.4% | 0.7% |

| Inflation | 2.9% | 1.8% |

* Statistical data related to USA, included in “2017 SBBI Yearbook Stocks, Bonds, Bills and Inflation” by Roger G. Ibbotson for the period 1926 - 2016

Choose the investment fund that suits you.

| Name | Currency / Minimum period | Risk | Type of investments |

|---|---|---|---|

| FDI BRD Simfonia | RON / 1 y | Low (2) | Investments mainly in fixed income instruments and money market instruments |

| FDI BRD Euro Fond | EUR / 1 y | Low (2) | Investments mainly in fixed income instruments and money market instruments |

| FDI BRD USD Fond | USD / 1 y | Medium-Low (3) | Investments mainly in fixed income instruments and money market instruments |

| FDI BRD Obligațiuni | RON / 3 y | Low (2) | Money investments and fixed income instruments |

| FDI BRD Diverso Class A / Class E | RON/EUR 3 y | Medium-low (3) | Diversified fund with investments in the stock markets, bonds and specific money market instruments |

| FDI BRD Acțiuni Class A / Class E | RON/EUR 5 y | Medium-High (4) | Equity fund |

| FDI BRD Global Class A | RON / 5 y | Medium-High (3) | Equity fund |

| FDI BRD Global Class E | EUR / 5 y | Medium-High (3) | Equity fund |

| FDI BRD Global Class U | USD / 5 y | Medium-High (4) | Equity fund |

| FDI BRD Simplu | RON / 1 m | Very Low (1) | Fixed income fund |

| FDI BRD Orizont 2035 | RON/EUR / 5 y | Medium-High (3) | Target date fund |

| FDI BRD Orizont 2045 | RON/EUR / 5 y | Medium-High (4) | Target date fund |

| FDI BRD Oportunitati | RON/EUR / 5 y | Medium-High (3) | Investments mainly in fixed income instruments and money market instruments |

| FDI BRD Oportunitati | USD / 5 y | Medium-High (4) | Investments mainly in fixed income instruments and money market instruments |

| FDI BRD Euro Simplu | EUR / 1 m | Very Low (1) | Fixed income fund |

Source:

Statistical data related to the USA, included in "2017 SBBI Yearbook Stocks, Bonds, Bills and Inflation" by Roger G. Ibbotson for the period 1926 - 2016, processed by BRD Asset Management S.A.I.

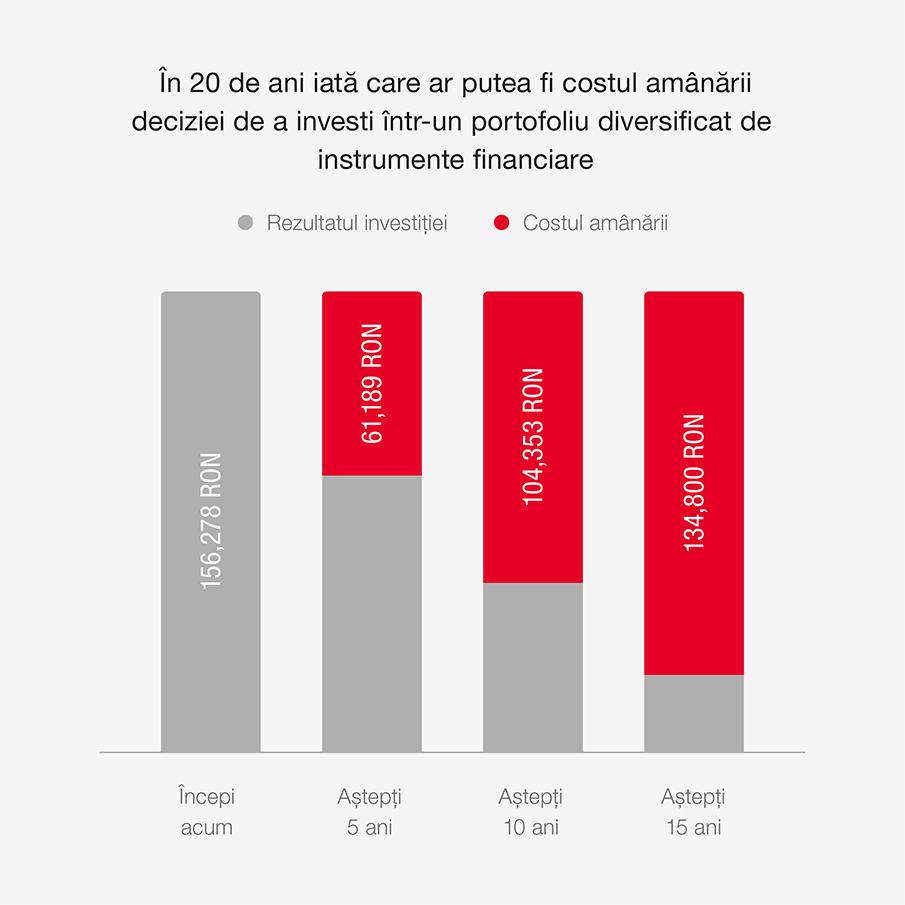

Disclaimer: “The yield used in the example proposed by BRD Asset Management SAI (7% annual average yield) is based on:

The presented model is strictly exemplary on the basis of statistical data and is not based on information related to the assets structure or the evolution of the Funds Managed by BRD Asset Management SAI. Previous performance is not a guarantee of future results. "

And, in order to dispel the concern about subscription/redemption commissions, we tell you that no matter what choice you make, you have zero subscription/redemption commissions.